ASSA ABLOY’s Baker Addresses The Future of Mechanical Locks and Electronic Access Control

The purpose of this interview is for locksmiths/security professionals to get good information on the what, where, when and whys of mechanical locks and electronic access control products and systems.

Scott Baker is president of ASSA ABLOY EMS & OEM Group. This sub-group of ASSA ABLOY includes the well-known brands of Adams Rite, HES, Folger-Adam, Markar and Securitron. He is also involved in the sales effort for other ASSA ABLOY group companies including Medeco, Sargent, Corbin Russwin, Arrow, Yale, McKinney and many others.

Scott Baker started in the industry in 1984 as the field sales manager for Securitron, which was a small start-up company just outside of Los Angeles. He moved to Sparks, Nevada, in 1993 when Securitron re-located. He eventually was promoted to director of sales & marketing. Securitron was acquired by ASSA ABLOY in 1998 and Baker was made company president in 2002. He became group president in 2004 and the role has grown as more companies have been added to the group.

Following are the Ledger’s questions and Baker’s answers.

What are your thoughts on the future of electronic access control?

Electronic security is no longer the wave of the future; it is the wave of the present. Although electric locking is used on less than 5 percent of all commercial locked doors in the United States, I believe in the next five to ten years, approximately 20 percent of all locked door will have some electronic components. And every new building will have some component of electronics in it.

The capability of electronically controlling access provides capabilities far beyond anything a mechanical lock can provide. This is not to say that the mechanical lock is dead. There will be applications for mechanical locks for many more years. Electronic technology is racing ahead with rapid changes. Many new products are coming in the near future.

One direction is incorporating multiple components into a single product. Manufacturers are designing more ways to incorporate RFID into traditional locks. An example is the electromechanical lock equipped with a reader head or an electric strike with an RFID reader. This can eliminate the number of individual components in an access control system.

Another growth area is the application of smart card technology. In addition to a higher level of security, the smart card is capable of two-way communication. This enables the ability to provide more capability such as operating as a debit card in addition to providing access. Although the cost of smart cards is high, as more are being sold, the price will eventually drop, making them more competitive with the other card technologies. Eventually, smart card technology will be incorporated into cell phones enabling a person to use his or her cellular telephone to emit a signal in order to gain access.

With the growth of technology and the introduction of new products comes change. This is a significant problem for locksmiths and anyone involved in this industry knows products can become obsolete quickly. For this reason, it is extremely important for Assa Abloy to make new products backward compatible so installed systems are not forced into premature obsolescence.

What are some of the new or improved technologies of which we need to be aware?

Probably the most dramatic is the introduction of Power Over Ethernet (POE). With the improvement in POE technology, many security products will be able to receive their power from an Ethernet cable, no longer requiring separate wires. Technology will eventually reduce the need for separate power supplies.

Unfortunately, today POE is power limited, not able to provide sufficient power for many of the components of an access control system. As technologies and standards improve, POE locks, readers, cameras, etc., will provide the alternative to multiple wire runs. Companies who miss POE have a very limited future.

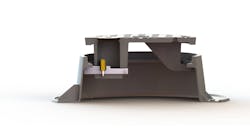

Electric strikes have become a significant participant in the world of access control. The main improvement in electric strike technology is in “ease of installation.” Surface mount electric strikes for rim exit devices do not require modification of the jamb. Electric strikes can be installed into the standard strike opening without modification. Many of these types of electric strikes can provide a solution for fire rated openings.

Over the last several years, magnetic locks have been under fire in some markets from an image and code perspective. However, improvements have been occurring that are turning this around. Magnetic locks are becoming smaller with greater holding force, while consuming less power. In addition, more components are being installed into electromagnets including camera and motion sensors. While sales are down from the 2008 high, there are some significant changes coming.

The 2012 International Building Code (IBC) model building code contains changes to the code that normalize magnetic lock installation in conjunction with UL listed exit devices including motion sensor or touch bar. Magnetic lock sales are expected to represent a significant part of the electronic locking market for the foreseeable future.

What is the role of wireless access control?

Wireless technology is a hot topic in the industry. Manufacturers are working to create products that function without wires. Wiring is easy in new construction, but can be very difficult in existing structures.

For most locksmiths the major part of their work is not new construction, and here wireless products are more practical in a number of situations. They offer ease of installation and can be used where running wire is impractical.

Wireless access control systems can provide semi real time communication. A battery powered installation by nature has limited communications. The reason is that communication requires power. Real time communication at this time is available only to hard-wired installations and plug-in powered wireless installations. For this reason, wired openings will continue to be the first choice for perimeter access control, but we will see an increase in the use of wireless locks on interior doors where the lower costs of wireless solution are attractive to providing additional security vs. a mechanical lock.

What are some of the opportunities for locksmiths?

Electronics have so much more value than mechanical locks. End-users are spending upwards of 20 times as much for electromechanical access control systems than for mechanical lock systems. A significant number of locksmiths have begun to sell complete electromechanical systems instead of standalone locks.

Locksmiths have the experience installing and servicing locks. Traditional access control integrator and dealers are normally afraid of mechanical locks. Contact access control companies and sub-contract. You provide the mechanical expertise.

Before you install an access control product or system for the end-user, “bench install” it. You will become familiar with programming, roughly know how long it takes to install. “Bench installing” will provide you with a more accurate time frame on which to base your costs.

Another advantage of “bench install” is if there is a need for assistance, you can call technical support. The Assa Abloy companies want you to be successful. They are there to help with one technical support telephone number that covers the entire Assa Abloy product line. The telephone number is 800-810-wire.

Assa Abloy lists education opportunities from all of their divisions at the web site www. assaabloyamericasuniversity.com. There are classroom courses and internet classes that cover the electromechanical and mechanical.

How can locksmiths better prepare for electronics?

The time for manufacturer required certification classes is coming. Before you can install specific high complexity products, the likelihood is certification will be required. When a locksmith installs a product for the end user, he or she is an agent of the company whose products they install. If a locksmith does not install the product or system properly, the company looks bad, and companies do not like to look bad.

Electronics are here to stay, and the applications for electronic access control are much greater than mechanical access control. For this reason, locksmiths should become hybrid locksmiths, someone who can install mechanical and electromechanical locks and components.

The last part and by far the hardest part is to learn how to sell. Do not sell expensive equipment on price; sell on value to the end-user to satisfy their needs. A locksmith must not be afraid to sell an expensive access control system. Do not think that the right solution is too expensive. Only your customer knows what they can afford and what is too expensive. Do not limit your customers’ options to a system that does not satisfy your customer’s requirements. Determine your customers’ requirements and offer them a choice of systems that meet their requirements. Learn to sell on the product capability and customers’ needs.

Will electronic access control have an increasing role in the residential market?

Most definitely. As an example, our Emtek residential lock business has recently introduced a keypad lock and deadbolt into their high end decorative hardware range. Keypad technology offers convenience but also the ability to electronically re-key your home in seconds. We see more companies interested in offering sophisticated control applications via a consumer’s cell phone or browser, and we expect the home locks to become a part of that overall solution in the future.

Do you envision new access control technologies in the future?

Access control is becoming huge, with more companies offering unique products and services. One amazing technology is equipping cell phones with smart card technology. This will marry access control with payment. For example, a person can make a hotel reservation and never have to check in. Once the room has been reserved, the person will get notification of the room number and how to gain access. Entering the hotel, he goes directly to the room and calls or instant messages and the cell phone becomes the key to unlock door as well as pay the bill.

Please explain the Securitron lifetime warranty.

The MagnaCare warranty has three key components. First is the obvious aspect of Lifetime. While this is the easiest to understand it is the least important. Second is the no fault aspect. This means that Securitron will replace that with new, no matter the reason it failed. This is really key as it protects the installer from any error they may make. Everyone wants to claim they are partners with the installer, but the lack of fine print proves Securitron stands behind that statement. And the third aspect is Securitron will ship the replacement free via next day air if needed.

Would you discuss the changes to the electronic product lines of the ASSA ABLOY companies and how they benefit locksmiths.

For ASSA ABLOY, companies need to stand for something specific, including types of products. To this end, the Securitron product line will be magnetic locks and accessories for the access control industry. Securitron and HES are in the business of products that goes on the frame around the door. Sargent Lock, for example is in the business of products that install onto the door.

Regardless of how a product is branded, the ASSA ABLOY companies are becoming more like a total group instead of individual companies. An example of this is the 800-810-WIRE technical support telephone number. The idea behind 800-810-WIRE is to help solve the “its the other company’s problem” mindset. It will take time to solve all of the problems. This is a major effort in that direction.

Scott Baker started in the industry in 1984 as field sales manager for Securitron, which was a small start up company just outside of Los Angeles. He moved to Sparks, Nev., in 1993 when Securitron re-located. He eventually was promoted to director of sales & marketing. Securitron was acquired by ASSA ABLOY in 1998 and Baker was made president in 2002. He was made group president in 2004 and the role has grown as more companies have been added to the group.